AHDB has expanded its Recommended Lists with almost 30 varieties added for 2020 and OSR markets looking set to see the biggest change. CPM takes an in-depth look at who’s come and who’s gone.

New options for all regions present growers with a step forward in yields, combined with improved disease resistance.

By Charlotte Cunningham

The 2020/21 Recommended List are overall slightly bigger in size, with a notable 27 varieties added to this year’s list, filling the spots of 21 predecessors who have been removed. With 13 new entrants, it’s fair to say that OSR has experienced the biggest shake up. So what’s new and what’s been dropped?

Oilseed rape

OSR has been in the headlines lately and all for the wrong reasons. However, the crop looks to attract a little more positivity with a baker’s dozen new varieties making their way onto this year’s Recommended List, broadening the options for growers.

Despite a tough time for the crop at present, the new options for all regions present growers with a step forward in yields, combined with improved disease resistance, comments AHDB’s Dr Paul Gosling.

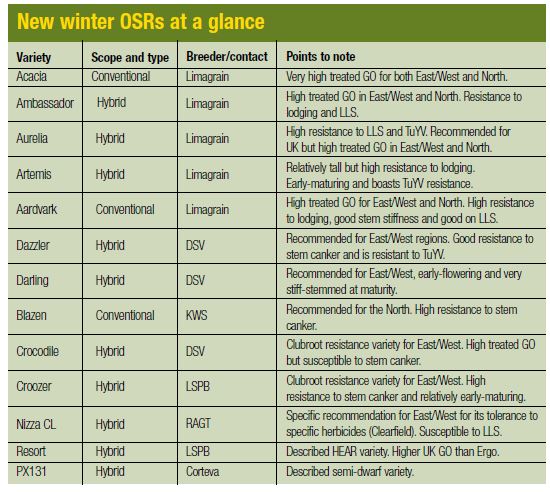

Of the 13 new entrants, eight slot into the general purpose category with Limagrain claiming the title for the most represented breeder with five new varieties — Acacia, Ambassador, Aurelia, Artemis and Aardvark.

“It’s certainly an exciting time for the Limagrain OSR-breeding programme as this is the first time that any breeder has achieved this leading position with this many varieties,” comments Vasilis Gegas, Limagrain’s OSR european portfolio manager.

Acacia sits at the top of the table with an impressive 110% gross output yield in the East/West region. “This high yield isn’t to the detriment of agronomic characteristics either, with the variety presenting itself as fairly stiff strawed and a similar — if not better — disease resistance compared with current varieties,” adds Paul.

It doesn’t, however, benefit from TuYV resistance, although according to Paul a quarter of varieties on the RL now do.

With a score of 8 for both light leaf spot (LLS) and phoma — as well as TuVY — Aurelia is worth noting for those growers looking for a beefier, more robust OSR variety. For the East/West region, new entrants Dazzler and Darling — from DSV— combine good yields with a strong disease package, including stem canker ratings of 8 and TuYV resistance.

For growers in the North, newcomer Blazen — from KWS — boasts high GO yields of 105% (based on limited data), good disease resistance and short, stiff straw, says Paul.

Shifting focus to the specialist varieties, Crocodile — from DSV — and Croozer from LSPB have been recommended for the for the East/West region. According to Paul, these varieties offer resistance to clubroot and are noted for having short, stiff straw as well as yields of 105% and 102%, respectively.

In terms of visual representation on the RL, specialist clubroot varieties have been separated and come with a warning to farmers considering growing them. “The clubroot pathogen exists as different strains and the relative proportion of these strains will vary from location to location,” explains Paul. “Clubroot resistant varieties are resistant to common clubroot strains and are recommended for growing on infected land.

“Some strains of clubroot may overcome the resistance in these varieties and growing them repeatedly could select for these more virulent strains, potentially causing the resistance genes to become ineffective.”

For the first time in a while, a semi-dwarf has been added. PX131 — from Corteva — is a ‘described’ semi-dwarf variety with good stem canker and light leaf spot resistance. How this will fare in the market, is yet to be confirmed, adds Paul.

Also recommended for this region is the herbicide-tolerant (Clearfield) variety Nizza CL. The variety from RAGT boasts stiff straw and good phoma stem canker resistance, however does fall short on the LLS resistance front with a rating of 4.

Finally in the OSR category is described variety, Resort — a high erucic acid rape variety which has replaced Ergo. Compared to Ergo, Resort offers increased yield and better disease ratings, notes Paul.

At the other end of the spectrum, the varieties Campus, Aquila, Flamingo, Wembley, Alizze, Mentor and Ergo leave the list for 2020/21.

Barley

Things look to be less dynamic on the winter barley front with no new malting varieties recommended but two new feed varieties, recommended for the UK.

Newcomers KWS Hawking, from KWS, and Jordan from Elsoms Ackerman Barley have replaced KWS Infinity and Sunningdale and boast UK yields of 104% and 103%, respectively — pipping their nearest competitors, KWS Gimlet and Surge to the post.

There’s a little more diversity for spring barley growers, which after this season could be a more popular option, notes Paul.

Olympus, KWS Irina, LG Tomahawk, Scholar, Ovation, Chanson and Hacker have slipped off this year’s RL in favour of potential malting types: SY Splendor (Syngenta); Firefoxx (Elsoms Ackermann Barley); SY Tugnsten (Syngenta); Iconic (Agrii) and new feed varieties — Fairway and Prospect — both from Senova.

SY Splendor heads up the newcomers with the potential for brewing and boasts an impressive UK yield of 107%. It does, however, falter slightly with an increased susceptibility to brown rust (4), adds Paul.

From the same stable, SY Tungsten looks set to offer a double whammy, with the potential for both brewing and malt distilling, giving growers more bang for their buck, so to speak.

According to Syngenta’s Tracy Creasy, the variety raises the bar for an important quality trait that end users look for as a measure of alcohol yield. “It has the highest hot water extract figure on the spring barley RL, at 316.8. This is in addition to a low grain nitrogen content of 1.43% and a very good 67.7 kg/hl specific weight.”

Oats

With just Griffin removed and no new entries, it’s quiet on the winter oat front. But there is one new spring variety making its way onto the list.

WSPB Isabel is a husked variety bred by KWS which boasts very good quality as well a 2% yield advantage over Canyon and Aspen, at 104% (UK treated). “It also has low screenings of just 2.3% which when added to its other attributes make for a variety with strong appeal to both growers and end users,” says KWS’ Will Compson.

Wheat

Four new winter varieties have been added this year, with Group 4 hard wheat growers set to benefit the most.

New for the soft Group 4 market is RGT Saki, while the Group 4 hard sector sees the addition of SY Insitor from Syngenta, KWS Kinetic from KWS and Theodore from DSV. All but Theodore have been recommended for the UK, while the DSV variety is suited mainly to the West.

These newcomers replace KWS Trinity, Myriad, Evolution and Senova’s much-loved JB Diego which has finally fallen off the RL after first being recommended in 2008 and dominating much of the market share during its reign.

RGT Saki comes in at 104% for UK treated yield — pipping its nearest competitor LG Spotlight to the post. “Untreated yield is the best indication we have of how durable a variety is, but to be a commercial success the variety also needs a very high treated yield,” says RAGT cereal and OSR product manager, Tom Dummett. “This combination has proved elusive until now. RGT Saki delivers an impressive 104% of control in fungicide-treated trials and 86% of treated controls in untreated trials.”

Moving on to Group 4 hard wheats, new entrant Theodore appears to be quite an exciting addition, with the highest untreated yield on the Group 4 RL — apart from KWS Extase. As well as this, it also boasts a robust disease package and is likely to attract the attention of septoria-ridden growers in the West, with an impressive score of 8.2 — the highest on the RL this year.

The slight flaw is the lack of OWBM resistance, as well as a tendency to give low specific weights, says Paul. “However, newcomers SY Insitor and KWS Kinetic do tick the OWBM box and also boast fairly high treated yields across the UK.”

There’s only one change in the spring wheat category, with KWS Willow replaced by the firm’s new KWS Giraffe — a soft Group 2, boasting good Hagbergs, grain proteins and specific weights.

“Despite its name, the variety is actually fairly short in height at 80cm – compared to 84cm from its nearest competitor, KWS Cochise,” explains Paul. “Over three years testing, KWS Giraffe presented similar analytical qualities to Mulika, with good gluten quality. However, there was some variability in baking performance, hence its listing as a Group 2, but nabim supported its inclusion on the list.”

Rust resurgence

When checking out the 2020/21 RL, it’s obvious that there are some fairly poor scores for yellow and brown rust, but what has caused this? “Reports of unexpected levels of rust on some varieties in 2019 led to questions about new rust races emerging and the veracity of the RL rust ratings,” explains Paul. “As a result, yellow rust and brown rust RL data were subject to additional checks which showed that varietal resistance was generally in line with recent years.”

Despite this, some varieties have had their rust ratings reduced by one point, with KWS Firefly’s brown rust rating losing two points.

While the scores give an indicator of the potential of a variety, being vigilant in the coming season is essential, adds Paul. “It’s important to emphasise that the RL disease ratings reflect an average UK situation. RL trials cover a wide range of agronomic and climatic conditions, but yellow and brown rust populations are highly diverse and dynamic, with potentially different races being present across fields and, in some cases, even from plant to plant.”

This has been reflected in this year’s RL design, with rust scores highlighted and advisory notice to the same effect as the above warning in place for growers.

Digital revolution

As well as announcing the latest recommended varieties, AHDB also released the news of its new app which is set to replace the Pocketbooks and should be available from next year, designed to make the RL more accessible.

While the fully-functioning version isn’t expected to be available until May next year, the new RL app will be available to all levy payers and will be available on Apple and Android.

A particularly neat feature of the app is that users will be able to benefit from updated information about candidate varieties throughout the season as they achieve National Listing. See more here.

The levy board is also expanding its web-based services with a new variety selection tool which is available immediately.

Pulses steady, despite bumper crop

There’s not a lot of excitement on the new PGRO Recommended Lists for beans, according to PGRO’s Stephen Belcher. But a new white pea with an “exceptional” yield has joined the line-up of combining peas for 2020.

Kameleon from Senova has a yield score of 114%, outyielding the next best (large blue Kactus) by a full 7%. “It’s been a long time since a new introduction has outyielded significantly, and that difference is huge,” notes Stephen.

White peas don’t represent a major market for the UK, with 85-90% of the 40,000ha sown to blue and marrowfat types. “Worldwide, white (AKA yellow) peas represent the bigger cropped area – it’s a market unlikely to come to the UK but is this one we should be looking at?” he asks.

Prospects for the 2019 pulse crop look good, reports Pulses UK president Lewis Cottey. He puts the overall size of the bean crop at around 600,000t, following a good harvest. That’s considerably higher than last year, resulting in a large exportable surplus, but the trade has had some success in finding homes for this already, he says.

“We’re seeing strong demand from Sudan for beans for human consumption, but note this is a market that closes in Feb. Also, bruchid damage means over 85% of the UK crop is only suitable for feed.”

With the scale back on this autumn’s UK oilseed area and poor winter cereal plantings, the latest AHDB Early Bird survey estimates the 2020 pulse area will rise by 24%, and it’s a rise Lewis welcomes. “The UK is really the only country currently in the EU with an exportable surplus, with demand steadily rising each year,” he notes.

“Seed availability in 2020 will be a limiting factor, and growers must aim for a quality sample. But despite a large 2019 crop and the prospect of the same next year, I don’t see that the market will turn mega-bearish.”

The winter 2019 issue of the Pulse magazine, included with the Dec issue of CPM, has Lewis’ full report on the market. There’s also a four-page pull-out of the full PGRO RL, and Stephen’s analysis.