An impressively high septoria score has put a bow wave of excitement ahead of KWS Extase’s first full commercial year. CPM visits a Suffolk seed grower who feels the fervour may be well founded.

No one was talking about Extase when we were initially asked to grow it last year, and now it seems to be the variety everyone wants.

By Tom Allen-Stevens

Chris Bull stops for a moment and looks across the field, then reverses. “The line between the two drilling dates is here somewhere,” he says.

We’re looking across a 63ha field of KWS Extase, drilled into Hanslope Series clay following sugar beet. But this field, a seed crop grown by S Bull and Sons, based at Hitcham in Suffolk, was drilled on three different drilling dates as the beet was lifted – the first week of Oct, 15 Nov and 30 Nov.

With its flag leaf already out, there’s barely a sign of disease on any of the top four leaves and the stem of the early-drilled Extase.

“I’m actually impressed with how well the later-drilled crop has caught up – you can barely tell the difference until you get close up,” notes Chris.

A wander into the early-drilled part of the field reveals it’s already showing its flag leaf on 10 May, but Chris doesn’t seem to be in a rush to get the sprayer out. “It didn’t have a T0 spray – just a T1 so far – and there’s barely a sign of disease on any of the top four leaves and the stem. Admittedly it’s been a kind year for disease, but this is a full crop, so Extase is showing its strength.”

That’ll probably be its 8.1 for Septoria tritici – the highest score a variety has achieved on the AHDB Recommended List. And other strengths come to the fore as we move into the later-drilled crop. “It suffered a little in the dry conditions, but has come back nicely now moisture has returned, and really caught up. I wouldn’t be surprised if it all comes fit for harvest at the same time, despite being drilled almost two months apart,” adds Chris.

The field represents one of the biggest single blocks of KWS Extase grown in the UK for C2 certified seed this year. For S Bull and Sons, this is where the business makes its mark – with 1000ha of arable crops, most are grown under contract for seed, multiplying up what the trade (mainly Frontier as well as Openfield) feel will be the big winners in the new season. Alongside Extase, KWS Siskin, Skyfall, Crusoe, Gleam, Shabras, KWS Kinetic and KWS Basset are in the ground.

“No one was talking about Extase when we were initially asked to grow it last year, and now it seems to be the variety everyone wants. It’s a good working relationship we have with Frontier,” says Chris.

The business was started by his great grandfather almost 100 years ago with a lease on just 49ha. It gradually grew, taking on more land over the next two generations, specialising into seed during the 1970s, and is now run by Chris with his uncle Peter Bull.

“We used to grow high grade seed for CPB Twyford and PBI,” recalls Peter. “But it’s high risk and some varieties didn’t make it. So we go for varieties that are dead certs these days. It means you can’t be too parochial with your choice of variety – so while yellow rust may be the key disease in this area, we’re very conscious of septoria scores, for example.”

The rotation includes sugar beet and oilseed rape, while spring barley has been brought in to help with blackgrass. “We’ll generally follow a break crop with two years of the same wheat variety,” continues Chris. “We’ve tended to go towards the milling varieties as you get the better premium. Then what doesn’t go for seed will get a milling premium.”

This is what drew them initially towards Siskin. “Again, it was Frontier which suggested the variety about five years ago. Its appeal was its good disease resistance as well as its yield. But in the first year we grew it, we did have problems with lodging where we’d overlapped on fertiliser – you have to take care with the PGR on Siskin or it’ll tend to lean,” he notes.

“But I really like Siskin. It’s a variety that consistently performs well for us with good grain quality and it’s clean, although we always give our wheats a robust fungicide programme. It also continues to be popular, though other varieties are now catching up on its disease scores.”

Last year’s crop was drilled in early Oct. “We’re still predominantly ploughing with two 6f Kverneland ploughs, although we go non-inversion with a Väderstad TopDown after OSR.”

The crop’s drilled with an 8m Väderstad Rapid. “Siskin is a very easy variety to grow, and we’ve never had trouble with disease – we aim for 10t/ha and would be disappointed with less. It also comes early to harvest, and although we don’t grow it as a milling crop, we find we get the milling spec, which is a nice bonus for anything that doesn’t go for seed.”

Last harvest, quality was exceptionally good, with a Hagberg of 395, protein at 13.9% and specific weight of 79kg/hl for a yield of 10.5t/ha.

Chris has high hopes for this year’s Extase. “Siskin’s only downside is its stiffness. Extase is taller, but does seem to have a good stem and is claimed to be stiffer. It’s also done exceptionally well in the late slot and didn’t need a T0 spray.

“I’m conscious it’s been an easy first year for Extase and Nature has a way of knocking back a high septoria score once a variety has been in the field for a couple of seasons. But with the loss of chlorothalonil, I can see a lot of growers will be drawn to this variety. So there’s been a lot of hype, but perhaps with good reason.”

Buy-back contract leads Group 2 appeal

Recent Group 2 newcomers to the RL, classed as such by nabim, offer a sense of security to millers as well as a premium potential to growers, according to Heygates senior executive George Mason. The company has recently announced it’s offering buy-back contracts for KWS Extase, starting from harvest 2020.

“We like the story with Extase,” he says. “In milling terms, it has the best of both worlds – good functionality and good harvest quality. It means we have the opportunity to reduce our reliance on imported European grain, and with all the uncertainty over Brexit, that’s a real reassurance.

“For the grower there’s a high untreated yield, a great disease profile and its earliness to harvest. At a time when fungicide choices are reducing, this has to be a good thing.”

In recent years, the Group 2 wheat market has suffered a poor uptake by growers, falling to a low of just 95,000ha grown in 2017, according to AHDB, compared with 838,000ha drilled with Group 4 varieties. It also suffers the worst prospects of meeting a miller’s full spec, compared with Group 1 and 3 types, with just 12% of samples achieving this from the 2018 harvest. “This may well be due to an element of growers aiming for the low protein domestic demand or for the export market,” notes George.

But prospects for the Group 2s are now looking up, with over 10% of the current wheat area drilled with the varieties, and he feels growers shouldn’t be put off by uncertainty over spec. “We’re considering a range of protein levels for the Extase contract, from full spec (at 13% protein) through to culinary flour (at 11% protein). We can also offer a further safety net on specific weight to 74kg/hl on full spec and 72kg/hl on 11%.”

Group 2 varieties do a very similar job in the grist to Group 1s, he explains. “We start to evaluate new varieties from very early on in their lives. The difference between a Group 1 and Group 2 variety is consistency over a number of years and harvests. We’re very lucky in the UK at the moment – the functionality of today’s milling varieties is very good, and this makes it a market worth aiming for.”

As the UK wheat area has dropped away, so too have exports, he notes. “But in years gone by, this has also proven a valuable market for Group 2s grown near a port, with a minimum spec of 11.5% protein.”

Heygates has four flour mills spanning the East Midlands and East Anglia – Bugbrooke, Northants; Downham Market, Norfolk; Tring, Herts and Icklingham, Suffolk. This means the buy-back contracts for Extase will likely appeal to growers across central England and East Anglia, says George. “Growers can choose between a single year contract or one spanning several years, and there’s no additional protocol to follow that prohibits the use of certain products,” he adds.

Seed availability is likely to be tight for KWS Extase for autumn 2019, but stable mate KWS Siskin was one of the most popular wheats drilled last autumn, according to certified seed sales, and it’s the highest yielding breadmaker on the RL, says KWS cereals and sales manager Will Compson. “KWS Siskin offers a strong proposition of established end-user demand, good agronomics and excellent on-farm performance,” he adds. A cross of KWS Sterling with Timaru, it also has ukp status for export.

KWS Extase comes from the Momont breeding programme in France – a cross of Boisseau and Solheio. “Its headline story is its high septoria resistance, but there’s so much more to Extase,” enthuses John Miles of KWS.

“For growers in the East, it’s early maturing and has a stiff stem. There’s a fast speed of development, making Extase suitable in the late-drilling slot for those with blackgrass, and there’s a good yellow rust score.

“In the West you need a 6.5 for septoria as a minimum, and its leading untreated yield – a full seven points beyond the next best – will appeal here. Extase offers robustness, with its high grain quality. And while KWS Lili is our lead Group 2 variety in the North, Extase is just a shade behind, offering earliness and good harvest quality.”

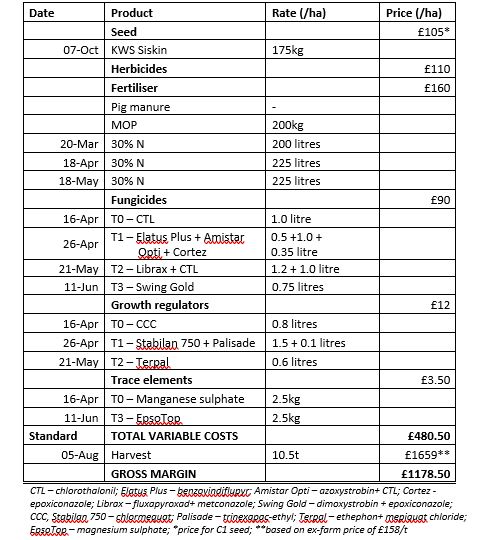

S Bull and Sons’ programme for Group 2 wheat, 2018

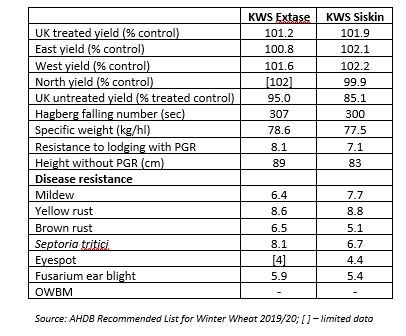

Group 2 wheat RL leaders at a glance

Fit for the Future

As Britain exits the EU, wheat growers will be preparing their enterprise for a market with less protection, but potentially open to the opportunities of a wider world. Finding the right market, and the variety to fulfil it, will be crucial for those looking to get ahead.

In this series of articles, CPM has teamed up with KWS to explore how the wheat market may evolve, and profile growers set to deliver ongoing profitability.

KWS is a leading breeder of cereals, oilseeds, sugar beet and maize. As a family-owned business, it is truly independent and entirely focussed on promoting success through the continual improvement of varieties with higher yields, strong disease and pest resistance, and excellent grain quality. We’re committed to your future just as much as you are.