The Group 3 wheat market has always presented a valuable and unique prospect for UK growers. CPM visits a Suffolk farmer who’s found the varieties that can now fulfil it.

I haven’t been this excited about a Group 3 wheat since Consort.

By Tom Allen-Stevens

As a seed grower, Tony Pulham admits that finding the right variety can be something of a gamble, especially when it comes to Group 3 wheats. But there’s one variety he’s growing at the moment he’s really quite excited about.

“We’ve been growing Group 3 and 4 wheats for many years,” he says. “While Group 4 varieties will always be popular, there’s less certainty with a Group 3. It’s not through lack of an end market, nor problems growing it – there’s always a demand for a soft Group 3. It’s the varieties themselves that haven’t been up to scratch.”

KWS Firefly has the full package of high yield and good agronomics.

That’s all set to change with KWS Firefly, he reckons. “I haven’t been this excited about a Group 3 wheat since Consort, and I think it’ll kick the others out of the picture. It’s a wheat that really does have the full package of high yield and good agronomics, so it’s set to fly off the shelf.”

Hugh Pulham Farms has 735ha of arable land, based at Stowmarket, Suffolk. The Beccles 1 and Ashley Association soils put some fine loam over clay behind a rotation that brings in oilseed rape, winter and spring barley, sugar beet and spring beans. Alongside the Firefly in the wheats this year, there’s KWS Kinetic, KWS Siskin, Graham, Gleam, RGT Gravity and LG Skyscraper, all grown for seed.

“We’d hope to average 10t/ha with the wheat, although we do suffer in a dry year,” he notes. After a three to four-year break from Group 3 varieties, Tony grew some KWS Barrel for 2017 harvest, and again in 2018. “I liked the look of both KWS Basset and Barrel. COFCO wanted Barrel and it’s proven to be a good variety,” he says.

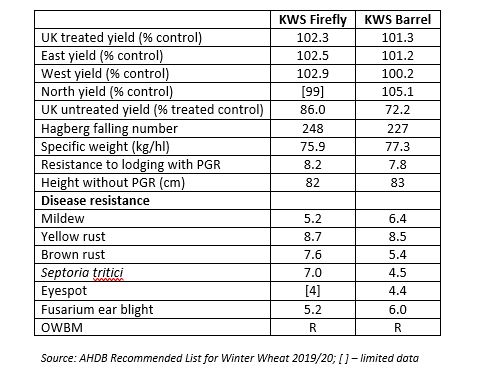

“What’s different about Barrel is that it yields. It’s also short, stiff-strawed and importantly it has orange wheat blossom midge (OWBM) resistance – this is becoming more important as we’re losing chemicals. It’s good overall on disease, although its one big failing is Septoria tritici. The quality of the grain’s also good – there’s a high specific weight.”

The quality of KWS Barrel is good, with a high specific weight.

Barrel lived up to expectations, yielding 9.8t/ha in 2017, with the drought pegging this back to 8.9t/ha last year. It restored Tony’s faith in Group 3 varieties. “I remember when Consort came along, we took a punt with it – I got hold of 4t of seed and had to grow as much of it as I could. So we drilled it at just 75kg/ha and it worked.”

He grew Consort for eight years, before switching into Robigus and then Viscount. “Then we went out of Group 3s, moving into KWS Lili and Siskin. We dropped Lili, but Siskin is currently the farm’s star performer, bringing us our highest ever yield in 2015 at 12.2t/ha. Last year its specific weight was 81kg/hl – the sample was like lead shot.”

He first saw Firefly when it was no more than just a code number in the KWS plots. “It looked really good, with a lovely ear and flag leaf. But it’s the figures that form the clincher with the variety – a really good yield backed up with a solid disease package and OWBM resistance again.

“It performs consistently and seems to do well whether on light or heavy soils,” he explains. “And while everyone looks for yield, agronomy is just as important these days – I reckon we’ll be able to knock £10/ha off our fungicide bill, compared with Barrel. Its only slight weakness is mildew.”

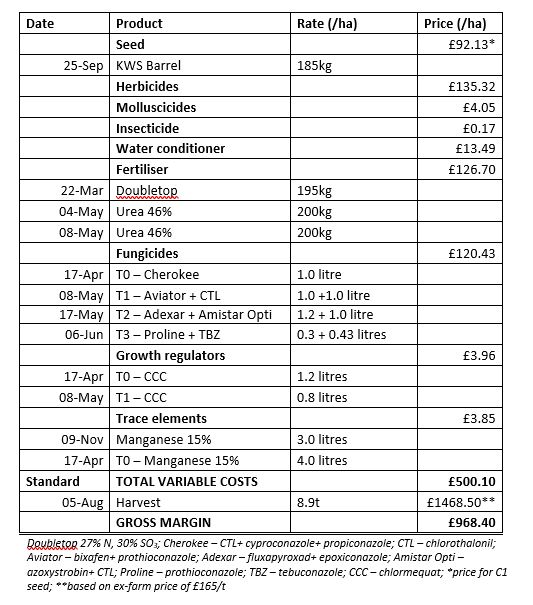

Tony’s found both Barrel and Firefly very easy wheats to grow. He aims to drill all wheats at the end of Sept, apart from those that follow sugar beet. A believer in giving the crop a “nice, deep tilth”, he’s just switched from a Simba Solo to a Väderstad Topdown as the main cultivation tool, aiming to move up to 225cm, before drilling with a 6m Väderstad Rapid.

Around 10t/ha of chicken muck, on a straw-for-muck deal, or Limex precede the wheat, and he aims not to roll. “If the seedbed’s good enough you shouldn’t need to, unless it’s very dry.

“We generally drill at quite a high seed rate – 185kg/ha, going up to 200-215kg/ha after sugar beet. I like to see the wheat when it’s up.”

Tony’s aim is to build tiller numbers and biomass from the word go and bring about a wheat plant which retains its green leaf area for as long as possible. “It’s a fairly high-input, high-output programme we follow, with four fungicides, and SDHIs included at both the T1 and T2 timings,” he notes.

To feed the growth, there’s an early application of Doubletop, followed by two dressings of urea. “One thing we’re focusing on at the moment is micronutrients – manganese is very important and wheats after sugar beet get boron to help with root growth. We’ve also looked at zinc and copper, but the jury’s still out on the role of many micronutrients in wheat – they’re not as important as they are in other crops.”

While many of the wheats get Moddus (trinexapac-ethyl) with the chlormequat, he’s found just straight CCC is all that’s needed for Barrel, and the Firefly is getting the same treatment. “The stiff straw is one of the advantages of both varieties – unless we get a change in conditions the crop shouldn’t need anything else to check its growth.”

Last year, everything looked well for the Barrel until the drought hit. “It was still greener for longer and harvested later than many of my neighbours, but 5-7 weeks without rain coupled with high temperatures cut its potential – it’s not often that feed barley out-yields wheat.”

The result in the end was just slightly above the farm average for the year of 8.6t/ha, with a specific weight of 77kg/hl. “As a Group 3 wheat I was very pleased with its performance, and the quality was there for any number of markets. It was also very easy to harvest – the ear threshes out well, producing a lovely sample with no chobs (wheat chaff and stem),” Tony notes.

“But as a seed grower I was slightly disappointed that demand for the variety was down last year and it didn’t all go for seed. I think it’s the septoria score that worries growers about Barrel, but that really isn’t a concern with the current crop of Firefly.”

This is now in the ground and has established well, putting on some strong roots, and came out of the winter with plenty of tillers. By mid April it had received its T0 fungicide spray. “The crop’s been knocked back slightly by a late frost and I’m now very concerned about the lack of moisture – we’ve had only 5mm of rain since Feb.

“But there’s no doubt this crop has some potential – there’s very little disease to speak of and a lovely, healthy root structure. It just needs warmth and water and I can see it being one of the top performers of the year.”

Hugh Pulham Farms’ recipe for Group 3 wheat, 2018

New biscuit varieties set to grab grower interest

Group 3 wheats offer growers in the eastern counties in particular the opportunity to capture a number of premium markets, notes Russell Frost, seed manager with international grain trader COFCO.

“There’s a good domestic market for biscuits, as well as access to export opportunities,” he says. “Growers have experience with the varieties, and the past success of Consort and Claire for example shows they’re not shy of growing them, provided they offer agronomic benefits.”

The typical spec for a Group 3 premium market is 10.7% protein, 180 Hagberg and 72kg/hl specific weight. AHDB figures show 82% of the current Group 3 crop (146,000ha for 2018 harvest) met the required spec – the highest success rate of any nabim group. With a market demand of 1M tonnes, there’s currently a supply shortfall of around 120,000t, however.

A projected increase in the area grown to Group 3 wheats of around 30,000ha may cover the shortfall, which is currently met through Group 4 soft wheats. But it’s a supply position UK millers don’t like, according to AHDB market specialist David Eudall. “A key requirement is consistency from the varieties they use – it’s not just about achieving 10.7% protein, but a functionality millers can actually include in the grist and rely on,” he points out.

Group 4 soft wheats don’t have the extensibility in the dough millers require for some uses in this market, while Group 3 varieties are classified as such by nabim because they uniquely achieve this. What’s more, it’s a quality spec that can’t be imported as no other country in the world grows this type of wheat. Speaking at an industry event last month, George Mason from Heygates drew attention to this. “Because of tightness of supply, we’re only one bad fusarium year away from a crisis in terms of our biscuit wheat supply,” he said.

So does that also make it a market prone to oversupply? The availability of Group 4 soft wheats keeps a lid on premiums, which are currently at around £5-10/t. While availability of contracts is good, growers are generally advised not to rely on the premium, although growing purely for yield is unlikely to compromise quality, as can be the case for bread-making wheats.

Historically there’s been a strong export demand, notably from N African millers, who have favoured the Group 3 wheats in particular as a constituent in their grists. But a lack of availability has recently kept UK wheats out of the market. “We have to produce enough wheat to export in the first place,” notes David.

“In 2016, for example, there was a big import demand into Morocco, and the UK met just a boat load and a half of this. We’re getting a reputation as a producer of feed wheat, which is a shame because only Group 3 wheats have that niche functionality that nowhere else can produce. It’s a tariff-free opportunity that will always be available if growers can commit to growing the right varieties.”

So are the right varieties available? Just five wheats on the AHDB Recommended List have nabim approval for use in UK biscuit and cake-making. KWS Barrel, KWS Basset and Zulu also meet the uks classification for export (typically 11%, 220Hg, 75kg/hl), with KWS Firefly and Elicit classed as provisionally suitable. There are no other wheats in official trials, including candidates, likely to meet the spec, however.

That said, the two RL leaders in the category, Firefly and Barrel, are very strong contenders, according to KWS wheat breeder Mark Dodds (see table below). A cross of Cougar with KWS Rowan, Firefly has the highest Hagberg of the Group 3s and has met the Group 3 criteria over three years of nabim testing. Barrel, a cross of Bantam and Viscount, is credited with reinvigorating the Group 3 sector, taking 3.7% of wheat certified sales in its first commercial year.

According to the AHDB 2018 planting survey, 73% of Group 3s are grown in the AHDB East region, which is where Firefly performs particularly well, notes Mark. “It not only has a 2% yield advantage over other Group 3s, it has security of field performance, with the best lodging scores and a septoria rating of 7.0. For growers in the West, it’s this septoria score as well as its Hagberg of 248s that give it a really strong package. A high, consistent performance and security in terms of application windows and standing ability are what will appeal most to growers.”

Group 3 wheat RL leaders at a glance

Fit for the Future

As Britain exits the EU, wheat growers will be preparing their enterprise for a market with less protection, but potentially open to the opportunities of a wider world. Finding the right market, and the variety to fulfil it, will be crucial for those looking to get ahead.

In this series of articles, CPM has teamed up with KWS to explore how the wheat market may evolve, and profile growers set to deliver ongoing profitability.

KWS is a leading breeder of cereals, oilseeds, sugar beet and maize. As a family-owned business, it is truly independent and entirely focussed on promoting success through the continual improvement of varieties with higher yields, strong disease and pest resistance, and excellent grain quality. We’re committed to your future just as much as you are.