The wheat variety that goes in the ground this autumn faces a future that’s far from certain. CPM tracks the progress of dynamic wheats to assess whether they meet the requirement as market mainstays.

I’d be going for a variety that opens up as many markets as possible.

By Tom Allen-Stevens

Over the past two months, the market for flour has surged, for beer it’s plummeted and milk has been poured down the drain. As you choose a wheat that you may not sell until May 2022, how can you possibly know what surprises the commodity markets will have in store when it gets there?

The truth is, you can’t, says Dr Kirsty Richards of KWS. “So it’s always good to keep your options open.”

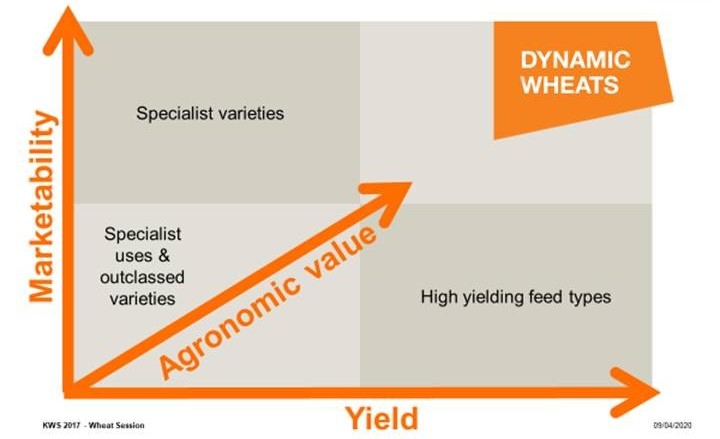

That’s been the thinking behind dynamic wheats. The concept was launched by KWS five years ago, and while the market’s changed considerably since then, the thinking behind it is just as relevant. “At the time, 65% of the wheat in the ground consisted of hard feed varieties. These have their place, but they’re a one-trick pony,” she says.

“Dynamic wheats have more market options, high yields and good agronomics. When we launched, KWS Trinity and Lili were the new varieties with bright prospects. Over the past five years, the market’s moved with a swing into Group 1, 2 and 3 varieties – these days KWS Zyatt is a good example of a dynamic wheat. Disease resistance has more recently taken the limelight – KWS Extase and Firefly are dynamic wheats that meet that requirement, too.”

Tom Eaton at Glencore has always been supportive of the concept of dynamic wheats. “Looking back five to ten years ago, the UK had a large exportable surplus, but it was all hard feed varieties we had trouble shifting – the markets of N Africa beckoned, but UK wheat couldn’t compete with the French. The only option was to sell into rock-bottom feed markets, such as in Asia.”

Contrast that with the situation this year – another one with a large exportable surplus. “We’ve sold 130,000t of milling wheat to Algeria. More has gone to Spain and Portugal. The difference is the UK is now growing wheat with the characteristics millers around the world like and the market is responding,” notes Tom.

The 2020/21 marketing season is shaping up to be a very different one, however. So how will the dynamic wheats fare? “We’re looking at a wheat crop of around 10M tonnes, against a domestic requirement of about 15M tonnes. With carry-over stocks we’ll probably be importing around 2-3M tonnes,” he suggests.

That’ll suck in wheat from the Black Sea and Baltic region, likely to be the cheapest source with plenty available. “Black Sea wheat will do for feed compounders and ethanol, so those growing hard feed types will compete directly at the bottom end of the market. But it won’t meet the quality required by domestic millers – only the premium US, Canadian and German wheats will fit here. So if you’re growing a dynamic wheat, that’s the market you’ll be trading in – a tidy premium of up to £30/t,” says Tom.

The current COVID-19 pandemic has caused an upheaval, but the grain trade has largely coped, he says. “The panic buying created a surge in demand for bread-making wheat, but this was offset by a drop in wheat required for biscuits and luxury items. That’s now plateaued and the main message to growers is that these sorts of upheavals shouldn’t affect your long-term strategy.”

Looking further ahead, Tom notes that much depends on forthcoming trade talks. “It’s difficult to know what the situation will be with the EU and US and what impact that will have on wheat prices, although a Nov 2021 ex-farm futures price sitting currently at £145-150/t is not a bad one to secure. If we get an open autumn, the UK will be putting a lot of wheat in the ground in favourable conditions, so we could again be looking at a large exportable surplus.

“In those circumstances, I’d be going for a variety that opens up as many markets as possible, whether that’s a milling home if you’re in the middle of the country or tapping into those premium export markets. The key aspects are firstly to take on a variety like KWS Zyatt that fits a lot of these opportunities, then grow it for the premium market you’re aiming for.”

It’s not just a question of choosing a wheat that’s dynamic in the market – it also helps if it’s dynamic in the mill. Shaun Taylor is technical director for Hovis and recalls that changes in the bakery market had led bakers and millers to take a more detailed approach to variety assessment considering performance across a broader range of products.

Characteristics such as stickiness and elasticity of the dough or product texture and volume were having different levels of importance depending on the process followed or products being produced,” he explains.

In three successive harvest years of work commissioned by KWS between 2015-18, he investigated KWS Zyatt’s performance in two processes – the artisan bake and the high-speed Chorleywood baking process. In both tests, he reported bread colour and texture were in line with industry standards producing finished product quality comparable with the top-performing nabim Group 1 wheat types.

Additionally he tested flour made from Zyatt in a range of applications including white and wholemeal bread, morning rolls, pizza bases and bagels, commenting at the time: “We were impressed with its versatility across a range of products where it either matched or outperformed the commercial flour controls. In the bagels and morning rolls it tended to deliver a finer texture than the control, but with the desired soft crumb and good flavour.”

So what does a dynamic wheat offer in the field? “Flexibility,” states KWS product development manager John Miles.

“It should perform across regions, won’t be too fussy on soil type, sit happily in both a first and second wheat situation and fit a wide range of drilling windows. To be fair, any variety that’s on the AHDB Recommended List meets the criteria of a dynamic wheat to a certain degree. But KWS Zyatt has it in spades.”

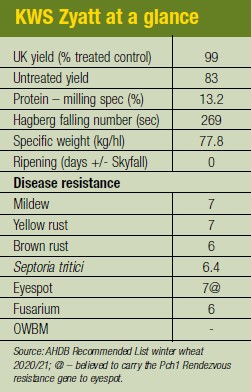

As a Quartz/Hereford cross, the variety has Cordiale in its parentage and stands out as a second wheat, he says. “A disease score of 6.4 for Septoria tritici gives it flexibility on fungicide timings, dose rates and to some extent products as well. Things are always changing on yellow rust – it’s a bit of a soup out there and you can never rely on varietal resistance – but Zyatt performs as well as any other variety.”

Zyatt has “get up and go” at establishment and in the spring and is early to harvest, he notes. “It’s a wheat you can grow with ease and it should bring you the quality. We may not get a new Group 1 variety for a while, so it’s worth getting the best out of this one.”

What are dynamic wheats?

Some specialist varieties are highly marketable but have low yield, such as Cordiale, while some of the standard Group 2 varieties, such as KWS Lili are examples of those that are now largely outclassed. KWS Kinetic is a good example of a high-yielding feed type wheat. But the Holy Grail can be found in the top right of the grid – KWS Extase, Zyatt and Firefly sit here, says Kirsty.

Some specialist varieties are highly marketable but have low yield, such as Cordiale, while some of the standard Group 2 varieties, such as KWS Lili are examples of those that are now largely outclassed. KWS Kinetic is a good example of a high-yielding feed type wheat. But the Holy Grail can be found in the top right of the grid – KWS Extase, Zyatt and Firefly sit here, says Kirsty.

A wheat that performs and won’t “back you into a corner”

For Jon Birchall, there are few experiences that beat walking through a really good crop of wheat as it approaches harvest. “It’s the sheer delight you get as you pass your hand over the ears and they push back at you,” he notes. “You know you have a crop that’ll perform when the combine goes through.”

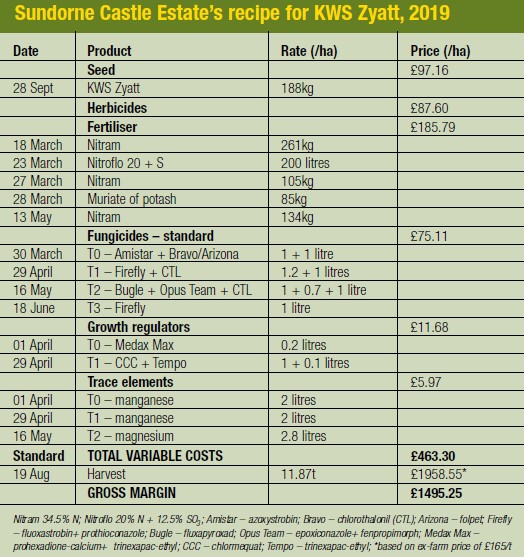

That’s exactly what happened last August with a crop of KWS Zyatt on the Sundorne Castle Estate, south east of Shrewsbury, Shrops. Jon is farm adviser across the 600ha estate of mainly sandy loams, which includes looking after its 160ha of wheat.

“We’ve always grown milling types and tried Zyatt for the first time in 2018, extending it as one of the main varieties next to Skyfall last year. I’d always considered Skyfall a bomb-proof variety, but it was all over the place last year on protein and yields, averaging 9.15t/ha, which is our long-term farm average,” he recalls.

“The Zyatt, however, yielded 11.87t/ha, and nearly all of it above 13% protein, 250 Hagberg and 76kg/hl specific weight.”

Farming reasonably close to the mills of Liverpool and Manchester, this is the market Jon aims for. “We tend to be fairly successful with achieving the top Group 1 spec, but what’s useful these days is when millers offer a range of premiums for loads that don’t quite meet it. Whether it goes for milling or otherwise, though, we want a darn good yield. We don’t want to back ourselves into a corner the moment we settle on a variety.”

That was the thinking behind Zyatt. He admits this particular crop had everything going for it – the field had received a generous plastering of biosolids and compost before being sown with the previous crop of oilseed rape. This one was drilled on 28 Sept at 350 seeds/m², into near ideal conditions with a Lemken power-harrow drill combination following a pass with a Sumo Trio.

“As for the agronomy, we really didn’t do anything radical with the Zyatt. We usually apply around 200kgN/ha plus the top-up for protein of 40kgN/ha. But an N-Min test revealed we could drop this to 212kgN/ha total. On our sandy loams, wheats are prone to die off early – we’re in a bit of a rain shadow – but this is where the variety really seemed to show its strength.”

Jon’s aware of the reports of yellow rust in Zyatt, but didn’t come across any problems in the crop. “Septoria is our main disease in this part of the world, so we tried some folpet alongside the chlorothalonil, which seemed to give us equal protection. I’m not a great believer in micronutrients, although we tend to add manganese to avoid deficiencies.”

This year, the Zyatt on the estate has picked up after the difficult winter and is “looking much more cheerful”, he reports. “I don’t think we’ll get the yield this year, but I’m looking to focus closely on net margin of the main wheat crops across all 1200ha I manage. We can’t afford variable yields and variable market returns as the Basic Payment drops away. On what we’ve seen of it so far, Zyatt fits well as a good mainstay wheat for an uncertain future,” concludes Jon.

Fit for the Future

In this series of articles, CPM has teamed up for the third year with KWS to explore how the wheat market may evolve, and profile growers set to deliver ongoing profitability.

The aim is to focus on the unique factors affecting variety performance, to optimise this and maximise return on investment. It highlights the value plant genetics can now play in variety selection as many factors are heavily influenced and even fixed by variety choice.

KWS is a leading breeder of cereals, oilseeds, sugar beet and maize. As a family-owned business, it is truly independent and entirely focused on promoting success through the continual improvement of varieties with higher yields, strong disease and pest resistance, and excellent grain quality. We’re committed to your future just as much as you are.