Defra’s provisional arable crop areas set out last week indicate a return to a more balanced cereal cropping picture for harvest 2021, according to AHDB. Charlotte Cunningham reports.

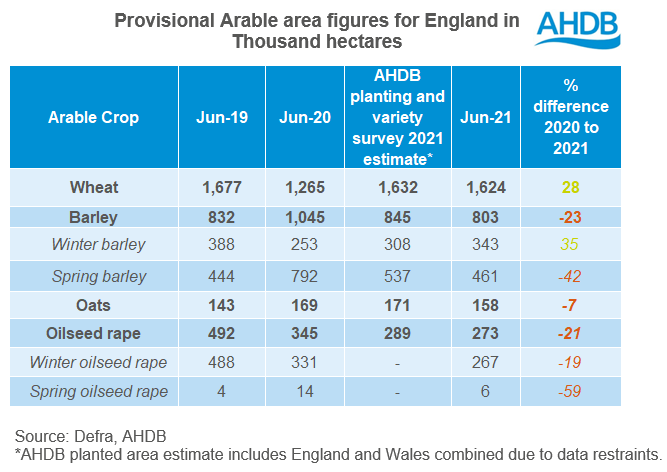

According to AHDB analyst, Megan Hesketh, the key standout difference within the report is the barley figures. “With spring barley area down 42% from 2020 and winter barley area up 35%, these increases and decreases from 2020 are shown to be more extreme than forecasted in the AHDB planted area figures,” she said.

The headline figures are shown below:

For wheat, the Defra figures confirm the forecast of increases in wheat area across all regions, she added. “The largest increase has been seen in the East and West Midlands, up 38% and 35% respectively. The eastern region by far remains the largest producing region according to the figures, accounting for 29% of the total English area.”

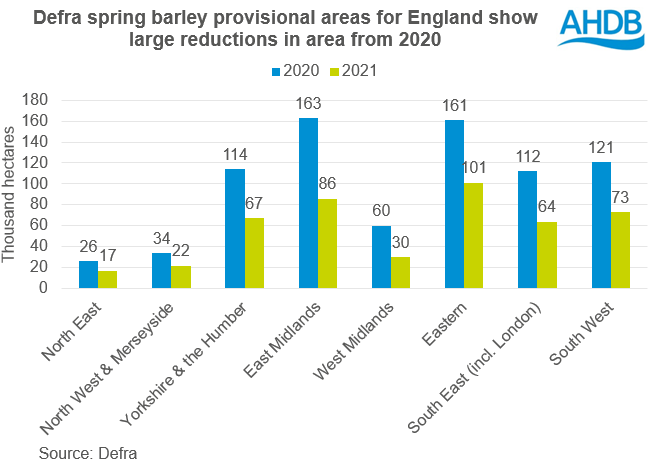

For spring barley, the Defra survey presented sharper cuts to area than seen in the AHDB planting and variety survey. This included the eastern region (down 37% from 2020) and East Midlands (down 47% from 2020).

With regards to winter barley and oilseed rape, winter barley harvest was 88% complete as of 12 August. “Using average yields from the latest AHDB harvest report, we can estimate production of winter barley for 2021,” she added.

Defra’s area figures show increases across the board in winter barley area. Average yields are pegged between 6.8t/ha and 7.2t/ha. This is broadly in line with the five-year and ten-year averages.

“Using the middle of this average, English winter barley production would be 2.4Mt, up 59% from last year but down 1% from the 5-year average (2015-2020).”

OSR harvest is not as far along as winter barley, however. “Though from the 61% harvested to 12 August, yields are currently estimated between 3.2 to 3.6t/ha.”

Using the middle of the average yield range, winter oilseed production looks to be up 3% from last year. This is despite a fall in area by 19%, noted Megan.

UK availability

In terms of what this means for UK availability, for wheat this confirmation remains positive, said added

“For wheat, this confirmation of increasing area remains positive. The global picture for wheat supply and demand looks tighter, due to concerns around the Russian, Canadian and US crops. Therefore, it’s likely domestic supply will be key this season. Monitoring cereal quality closely will be important in the coming weeks to see if samples meet specification. If we do see issues with domestic quality as harvest progresses, we could see milling premiums stretch out further.

“Over the past few weeks, we have looked at demand for barley and commented on what may look to be another strong year for demand. This should see barley remain in the feed ration as expected, if the discount to wheat remains strong. An increase in winter barley area and production looks positive, however this is met by falling spring barley area year-on-year. The question remains how tight supply and demand this season might be.

“Should wheat prices climb further, we could see a tightening of demand and supply for barley as barley remains in the ration.

“Finally for OSR, production for winter OSR looks to be positive. Despite area reductions, initial yield estimates present a more positive production outlook. However, global rapeseed supply remains tight. Wider support from challenges to the Canadian canola and EU rapeseed crops continue to support prices, a key point to watch in the coming weeks.”