With growers feeling the financial pressure after a disastrous autumn, farm business consultants warned visitors at LAMMA of the importance of controlling costs this year. CPM gathered an insight into the latest outlook.

As always, it’s dangerous to over-react on the basis of one season.

By Charlotte Cunningham

Having come through such a difficult season and not yet in the clear, it was somewhat awkward being surrounded by millions of pounds worth of kit, fresh off the production line, at this year’s LAMMA show.

Perhaps the elephant in the room was one single question: Are growers going to have the cash to splash out on new kit?

But away from the glitz and glam of said shiny kit, farm business consultants, Andersons, were grabbing the bull by the horns to discuss exactly what the impact of this season could be on growers and how, in fact, there may be other issues to look at.

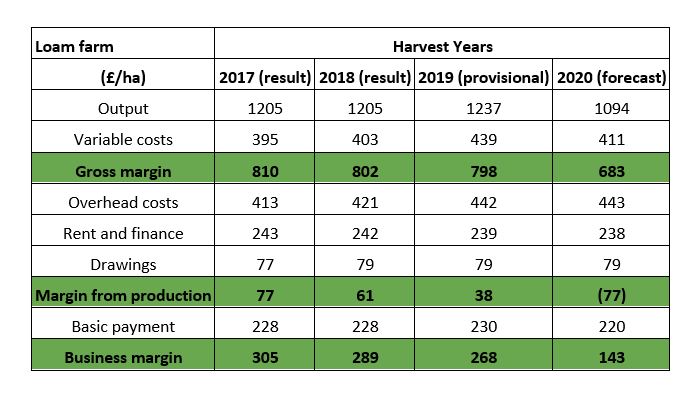

Andersons have been using their Loam Farm Model since 1991 to track the fortunes of British combinable cropping farms. It comprises 600ha in a standard rotation of milling wheat, oilseed rape, feed wheat and spring beans and is based on real-life data.

“British farmers are used to challenges from the weather and, as always, it’s dangerous to over-react on the basis of one season,” warned Richard King, head of business research. “However, the unusual conditions in autumn 2019 perhaps highlight more fundamental issues with UK combinable cropping systems.”

Though the weather has undoubtedly put additional pressure on growers, it’s Andersons belief that that it’s actually just exposed some underlying issues. “It’s almost become an article of faith over the past few decades that the route to profitability was scale and cropping ever-more acres,” adds Richard.

“For many businesses that has resulted in taking on land at high rents, often of dubious yield potential as a result of soil structure, weed burdens or drainage issues.

“This land will often be at a distance from the ‘core’ farm — the time and cost of long road journeys, plus the added difficulties of managing land remotely are some of the greatest hidden expenses in arable businesses.

“An autumn such as we‘ve just had simply serves to shine a light on such issues of overstretch.”

There’s also the question of whether all the land being sown is actually profitable in the first place, adds Richard. “Many fields consistently produce yields that are lower than that required to break-even after all costs.

“Some areas might be improved by remedial action but some are simply unsuited to arable cropping.

If you know it is going to produce a loss, why crop it?”

Richard believes that this logic can be extended in a difficult year by considering whether or not it’s actually worthwhile committing costs to establishing a crop in sub-optimal conditions when it’s unlikely to yield enough to pay those costs back.

However, the figures need to be carefully worked through when considering not cropping fields, he warns. “There are few ‘variable’ fixed costs (fuel, for example) to be saved unless a planned reorganisation will result in a lower total cost structure, to farm a reduced area. Additionally, depending on soil type, it’s likely that in the absence of a crop, some form of cover cropping will be required.”

While BPS may act as a welcome crutch this year, relying on it isn’t a safe place to be given the uncertainty of support payments going forward.

Since the briefing at LAMMA, the Agriculture Bill has been released which has provided some clarity in terms of how farmers will be subsidised in the future, as well as the Government committing to a seven-year transition period to phase out the Basic Payment scheme.

However, what it doesn’t elaborate on is what kind of figures growers can anticipate for undertaking ‘public good’ measures.

According to Jamie Mayhew, Andersons Eastern, the best way to prepare and plan for this, is to analyse the strength of your farm business without taking into account any kind of support payment.

“We’re really encouraging businesses to assess their cash generation with a reduced subsidy just to get an understanding of what the future could look like.”

What is obvious is that for many there’s going to have to be some tighter belts, and controlling costs is one of the key pieces of advice from Andersons as farmers head further into 2020. “A large part of this means looking at overheads — in particular, machinery and labour,” says Jamie. “We always try to encourage businesses to look at what the combined labour and power cost is as it can have a tendency to creep up.

“This could be due to changing machinery replacement policies, such as increasing the horsepower on replacement machinery which can bump up the depreciation. And obviously the cost of fuel and labour has increased over the past few years too.”

Jamie believes that going forward, it’s got to be all about utilising resources as efficiently as possible — and keeping those costs down — but more importantly, without affecting productivity and attention to detail on the ground. “Maybe that means asking yourself whether you’re farming a bit too much land and stretching your labour and power too much.

“Or maybe you’re over resourced and it’s perhaps worth seeking more land, at the right economics, to spread that cost. But at the same time, that’s not always a good approach, so do take into account the economies of scale.”

The Loam farm model — where do you stand?

According to Jamie, the past three years have seen some fairly good results for cereal farms in terms of both yields and prices. Unsurprisingly, however, things aren’t looking as rosy for 2020.

“A lot of farms are trying to finalise budgets for the 2020 harvest, but the reduced area of crops drilled in the Autumn makes this very difficult.”

While some growers may have been able to sneak a few hectares in throughout January, the reality is that there’s likely to be a lot more spring barley in the rotation this year, which could result in a reduction in price, he adds.

So how is this represented in terms of the Loam Farm Model?

“Looking at the 2020 budget on the Loam Farm Model, output is down but at the same time, we will also see a reduction in variable costs due to the additional spring cropping,” says Jamie.

“Unfortunately, overhead costs are likely to remain relatively static — though there will be some which vary according to drilled area, such as fuel and casual labour, which will depend on what crops are drilled and when.”

In light of the anticipated downturn in cash flow this year, one of the key advice points from Andersons is to look at the best way of generating income from your land. “Cropping wall to wall isn’t always the most beneficial option,” points out Jamie. “On some types of land, there are other options of income, such as through Countryside Stewardship, which can generate income in excess of £500/Ha.

“We have some clients who have implemented a stewardship agreement to take out the parts of fields which are challenging to farm leaving the remaining farmed area more efficient.

“If you’re not cropping an area of land or not receiving income from it (other than BPS), you don’t necessarily just get rid of your costs for the area. Something like a stewardship scheme can be better than the average rotational gross margin on poor land.”