After a period of minimal competition in the Group 3 soft wheat category, there’s a new contender shaking up the market. CPM reviews Elsoms’ new variety, Elicit.

This is what we need – it’s what we’ve been looking for a very long time.

By Charlotte Cunningham

Traditionally, yield has been the biggest influence on variety choice. However, with increasing concern around the future of crop chemistry, growers are now turning to robust varieties as the first line of defence.

With this in mind, breeders have been working to create varieties that boast high levels of resistance and good yields. Among these is Elicit, the latest offering from Elsoms which appears to be sparking major interest in the Group 3 market.

The variety is the son of Cassius and Viscount, both respectable, high-yielding varieties in their day, explains Stephen Smith, head of wheat breeding at Elsoms Wheat. “While both varieties were classified as Group 4 soft wheats, they were very close to meeting biscuit standard. They’re both very high yielding with good quality, so we knew that combining them together would produce a very attractive variety.”

From Cassius, Elicit draws good rust resistance, while it benefits from orange wheat blossom midge (OWBM)resistance inherited from Viscount. “It has an all-round safe package of characteristics.”

Elicit caught the attention of Gleadell Agriculture right from the start, says seed manager, Chris Guest. “During the NL1 and NL2 trials, Elicit flagged up as a variety of interest. Up until then, the Group 3 market had been relatively flat in terms of new material.”

One of the most attractive features is the variety’s strong septoria resistance, notes Chris. “Elicit has a number of very exciting attributes but stands out for its all-round foliar disease packages – most importantly, its septoria rating. At a score of 6.4, resistance levels are very solid and the highest in Group 3 wheats.”

Septoria has the reputation of being one of the most damaging, hard to control, threats to wheat growers – so is Elicit the answer? “Lots of farmers are very excited about the prospect of Elicit,” says Stephen. “Some people have been waiting 10 years for this type of variety to make its way on to the market – it stands out from everything else in the biscuit category in terms of its septoria score.”

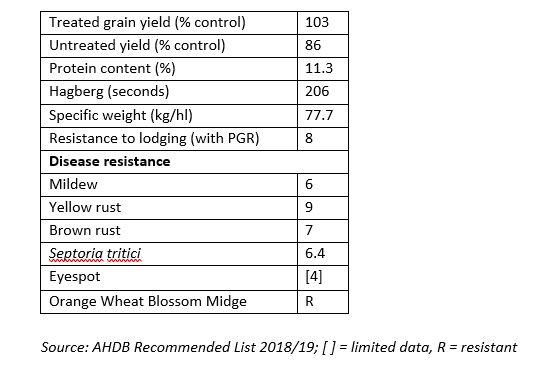

Elicit also boasts strong resistance to yellow rust and brown rust – with scores of 9 and 7, respectively – and benefits from OWBM resistance. “We don’t have a chemical solution available for OWBM, so variety resistance is the key line of defence,” he adds.

At 6.4, one of the most attractive features is Elicit’s strong septoria resistance.

Eyespot resistance is on the lower end of the scale at 4, however, in trials and as a second wheat Elicit hasn’t shown any issues with lodging, meaning it shouldn’t be too much of an issue for growers, says Stephen.

While yield is usually king, increased chemical costs mean growers are now favouring disease resistance, explains Chris. “If a variety is high yielding, but that yield comes with a high spend, then growers can be hesitant. They’re now much more prepared to take a balanced view on yield and chemical spend.”

However, the beauty of Elicit is that growers don’t have to necessarily choose between the two. It sits at the top of the Group 3s on the RL for untreated yield, and just a shade behind KWS Barrel with its treated performance – with scores of 86% and 103% respectively. “The old adage was that growers couldn’t select varieties that gave them yield improvements and septoria resistance,” says Chris. “However, this isn’t the case with Elicit.”

With the future of crop chemistry hanging in the balance, choosing a variety that performs well in terms of untreated yields has never been more important. So, how does it stack up in the field? “Elicit is a medium tall (85cm), stiff-strawed variety,” explains Chris. “It has good resistance to lodging with and without PGR (score 8 and 7) and isn’t particularly later maturing.”

In terms of grain quality, Elicit scores 11.3% for protein, 77.7kg/hl for specific weight and has a Hagberg falling number of 206. “In an ideal world, we would like to see 20 to 25 seconds more on Hagberg,” says Chris. “However, domestic contracts are based on 180, so it shouldn’t be too much of a problem.”

From a marketing perspective, while it’s still early days there are plenty of opportunities for Elicit growers, he explains. “Soft wheat users will buy it and it also has the uks export rating which opens another avenue – it seems to tick all of the boxes.”

Though it’s recommended for use across the UK, there’s often a demand for uks-certified varieties in the South East, which may favour the use of Elicit in this region. “Elicit could be a good move for Group 3 growers who have previously been using varieties like Scout, Zulu, Claire or Britannia,” says Chris. “For soft Group 4 growers, those that have previously grown varieties such as Revelation may be suited to Elicit, with the increased yield potential.”

Elicit’s success as a biscuit wheat will be determined not only by how growers take to it but also whether it’s deemed valuable by the end user. Heygates, one on the UK’s leading flour millers, has been tracking Elicit from the very early stages and is thoroughly impressed by what it has seen so far. “We’ve a vested interested in fit-for-purpose varieties,” explains George Mason, senior executive at Heygates. “We need a consistent supply of wheat varieties that are competitive to grow in both yield and disease profile but also supply what the end market requires.

“At quite an early stage in the development process, breeders will show us samples of a new variety – there’s no point in them investing in a variety that won’t benefit producers or manufacturers,” he adds. “We then feed back our results and if it’s determined as being good quality they’ll pursue it further.”

Elicit’s sound all round package grabbed the attention of Heygates, which notes its high yield, good quality and robust disease resistance as some of the key traits. “Elicit is among the the highest yielding Group 3s and its yield potential is only 1% lower than the highest yielding Group 4 soft variety,” adds George.

Though yield is still a key focus for growers, a shift in attitudes mean growers are now similarly looking to optimise disease resistance in their variety choice, he says. “Farmers are led by yield because the overriding thought it that a big yield equals a big profit. Genetic development has meant there has been an explosion in wheat yields over the past few decades, but recently that yield improvement has plateaued. As a result, both yield and disease resistance are at the forefront of decision making now.”

The launch of the variety comes at a time where soft wheat supply is tight. Looking at the bigger picture, Elicit could be the solution the market has been waiting for, he says. “It seems now that the proportion of Group 1 and Group 2 varieties planted in the UK is high and that soft varieties have become less popular. If we think back to 2000, around 50% of UK wheat crop was made up of soft varieties. Now, this is only about 20%. We’re just one poor harvest away from a real supply issue.

“If this should be the case, millers would have two options: to import from America – a costly, lengthy process – or, to blend what usable domestic wheat is available but with the threat of compromising product quality. Therefore, we really need something new and exciting to regain the correct balance of variety spread and may well need to be very specific about what we grow in the future. Elicit looks like it could fit that bill.”

As well as the greater choice that Elicit brings to the Group 3 market, there could also be financial benefits of growing it, explains George. “At the moment, soft wheat premiums are higher than Group 1 bread-making varieties. I haven’t known that for a long time, so this could be a good incentive for growers. It’s looking pretty exciting.”

With 2018 marking Elicit’s first year as an official recommended variety, market share is estimated at between 3 and 4%. “We put out a buy back contract before Christmas, which was quickly taken up, and we had some nice buzz around the trials last autumn,” says Chris. “From a grower’s point of view, it’s nice to see another Group 3 variety with that all important improved resistance.”

So what’s next for Elsoms? Stephen explains: “We currently have a high yielding Group 4 wheat in national listing trials and are trying to fast track potential sons and daughters of Elicit.”

High hopes for Elicit in Northants

After being impressed by the results right from the early trials, Northants grower Andrew Pitts is growing 30ha of Elicit for seed this year. “I looked at it in the trial stage two years ago and thought, ‘this is what we need – it’s what we’ve been looking for a very long time’,” he recalls.

Andrew, who farms 840ha of arable land at Grange Farm, Mears Ashby, was particularly impressed by the combination of high yield potential and the sound agronomic package that the variety offered. “It has good specific weight, no issues with lodging, isn’t particularly late maturing and has a very good treated and untreated yield – there are no holes in Elicit’s agronomic package.”

Given the robust disease profile, Andrew plans to apply a very straightforward fungicide programme this spring. “Compared with other similar varieties I estimate that Elicit could be £30-£40/ha cheaper to grow.”

While he is yet to see the harvest results on his own farm, the early signs are positive. “Elicit looks very good coming out of the winter and should be easy to manage in the spring,” says Andrew. “If we get delayed with our fungicide applications the good septoria resistance should buy us a few days.”

The farm currently grows four varieties: Skyfall, LG Motown, Elicit and a numbered variety. However, if Elicit performs well this year it could replace Motown going forward, he says. “If it delivers what we expect it to, we’ll grow Elicit commercially next year for local flour mills. For growers like myself in the East Mids, this is the variety we should be looking to grow and export.”

Elicit at a glance