A new British food ingredients company started out selling locally grown pea flour for gluten-free products. But then the market for this protein took it in a new, exciting direction. CPM travels to Norwich to find out more.

There couldn’t be a better crop for growers looking for a more sustainable way of farming.

By Tom Allen-Stevens

One of the big four supermarkets has introduced a new hoisin spring-roll wrap. Take a bite, and you can’t deny it really is rather delicious – everything a duck wrap should be.

Except it’s not duck. The texture and taste lead you to think it is, but it’s part of the retailer’s vegan-friendly 100% plant-based range of foods. What’s interesting about it is that this product is not sourced from South American soya (before you hurl your copy of CPM aside in disgust at apparently supporting substandard imports). It comes from peas grown by a group of Norfolk growers, and processed by a new start-up company, that’s owned by local entrepreneurs and investors, including those self-same growers.

Novofarina, based in Norwich, was first set up three and half years ago and set out to supply gluten-free flour from yellow peas (often referred to as white) to the baking industry. Robert Alston, based nearby at Church Farm, Carleton Forehoe, is one of the growers behind the venture. “We’d packed up growing sugar beet and were looking for another break crop for the rotation,” he recalls. “The trouble with peas and beans is the poor profitability.”

He’s part of a committee working with John Innes Centre looking to bring innovation into pulses, turn them into commercial reality and improve prospects for a crop that he maintains has highly sustainable credentials. “One day during a meeting of minds in the café at JIC, a group of us, including local entrepreneur Peter Briggs, were discussing the possibility that a market could open up for peas for its high protein, gluten-free flour, but the problem with using them is that they bring with them the distinctive taste.”

It’s this you appreciate in any number of traditional pea products, such as mushy peas and wasabi-flavoured pea snacks. But not a taste you’d enjoy in a chocolate brownie or pizza base, for example. This is where Dr Chris Harrison comes in, a former JIC scientist, who’s spent 20 years involved in tech start-ups but whose research background was in the starch synthesis of peas. Chris knew methods he believed could improve the quality and palatability of pea products. So together with Robert, Peter Briggs and legal expert Terry Gould, the four of them started Novofarina.

“The first task was to find the right pea,” continues Robert. “We carried out trials in a 4ha field in 2016 with a number of varieties, including vining types, and quickly settled on white/yellow pea Kareni. It ticks all the boxes for the end market – yellow in colour and it has at least 20% protein content that it delivers consistently. Importantly, its standing ability is very good.”

Novofarina’s first crop was harvested in 2017, and with a market steadily growing, there are now five growers in the group, some of them also investors in the company, with a total area harvested in 2019 of 182ha.

One of these is Robert Norman, who’s also an agronomist with Frontier and the group’s fieldsman. “The key for peas is free-draining soil – they hate compacted ground – so keep them away from root crops in the rotation. You’d look to drill from mid March to beginning of April, once soils are warm enough, and they have just a 110-day growing period, so peas are a good crop to help with blackgrass,” he notes.

With 450ha of cropped land, Silfield, Robert Alston’s farming business, has a rotation that puts potatoes one year in six, with oilseed rape the other break alongside his 50ha of Kareni peas. Winter wheat is the main cereal, with hybrid barley now replacing second wheat.

He prepares land straight after harvest with a Discordon going in up to 250mm deep into the soils that range from sandy loam to heavy clay. “We establish a cover crop, that’s sprayed off in mid March, pulling through a 6m Väderstad Rexius Twin if needed, in front of the 6m Horsch Pronto drill. We roll after to ensure an even soil surface for the pre-emergence Nirvana (imazamox+ pendimethalin).”

The main disease threat for peas is mildew, notes Robert Norman. “Wakil (cymoxanil+ fludioxonil+ metalaxyl-M) helps against early disease, although seed dressed with this fungicide cannot be sown until after 1 April, and it’s threatened with revocation.

“You want the crop to get away quick, with pea and bean weevil an early threat, and nutrition is key to achieving this. Fresh phosphate applied pre-drilling or soon after aids root establishment and kieserite or PK plus provide magnesium and sulphur. The use of phosphite early in the crop’s life as a biostimulant for root growth helps the crop gain access to nutrients and water. As peas are a pulse crop with an NMax we use a phosphite which contains no nitrogen.”

With ascochyta and rhizoctonia also disease threats, alongside mildew, he feels up to two doses of Amistar (azoxystrobin) and/or some powdered sulphur keep these in check. “It’s essential to be aware of pea moth. We put traps out then follow the in-season updates from PGRO,” he says.

“Agronomically, peas are a fairly easy crop to grow, with a good establishment absolutely key. The crop suffers from a restricted pesticide toolbox, which forces you to think harder and smarter,” he notes.

The withdrawal of diquat is a good example, but Robert Alston says the crop does senesce well by itself. “Peas come fit to harvest in between OSR and wheat. The advantage of that for us is that there’s little risk of contamination of the crop with wheat if the combine’s come fresh from OSR.”

Stringent hygiene procedures are necessary to keep the pea crop gluten-free. “Novofarina’s pea crop is stored off-farm in a dedicated silo. On farm, we have to ensure temporary storage is segregated well from wheat – dust can be enough to exceed tolerance.”

It requires a mindset to consider carefully the contamination risk, but it’s not onerous he says, and part-and-parcel of supplying the market with a quality specialist product. “I do enjoy being involved in the end product.

“What we’re aiming to do is emulate a soft wheat with the protein in the pea flour. There’s a whole range of gluten-free products this makes it useful for. But what we’ve actually found the industry wants more than anything is the protein itself – gluten-free is an added extra,” notes Robert Alston.

“This opens your eyes to the potential peas have. British-grown, the provenance is excellent and there couldn’t be a better crop for growers looking for a more sustainable way of farming. As a food ingredient, though, there’s so much you can do with peas. Its flour is a multipurpose product, useful for pretty much anything, and as a meat replacement it’s ideal – that’s the exciting part.”

Meat-free movement drives market for pea protein

Tucked away on a Norwich industrial estate, Novofarina is finding it’s happened on a marketplace that’s full of opportunity. Here the company has developed and successfully scaled up its patent-pending process that delivers the gluten-free, high-protein flour without the bitter taste, introduced by co-founder Chris Harrison. This has given the pea flour access to the market, but it’s by no means its only attribute, as marketing and sales manager Vicki Myhill explains.

“We process the whole pea, including the hull, which means it contains far more protein and fibre than other gluten-free flours. This also gives it a considerable nutritional value, making it a much healthier ingredient than many of its competitors.”

There’s a stringent quality assurance process, from farm right through to end product that ensures the flour stays below the 20 parts per million threshold of gluten-containing contaminates. This is overseen by Veronica Grube.

“One of the biggest risks is cross-contamination with wheat, and that can very easily happen on farm,” she explains. “So the growers have to ensure they segregate crops – it’s a little more onerous than Red Tractor standards, but our growers don’t find it a problem, understand why it’s necessary and are keen to respect the standard required.”

Nevertheless, the peas are thoroughly cleaned and packed into 1t tote bags which Veronica samples before they’re sealed. Processed by a mill with a dedicated gluten-free line, more samples are taken to verify the end product is gluten-free, she adds.

“It was our belief at first that the gluten-free marketplace would drive demand for the flour,” continues Vicki. “But the market has evolved and almost came to us.”

So the core products are the soft, gluten-free flour, while there’s also a pea-zza base mix, a tempura batter and a pea-based crumb. “The batter has proven really popular as it fries at a low temperature and browns easily. But what we found was that the flour also extrudes really well. That makes it suitable for crispy snacks, so we’ve moved from solely selling business-to-business to supplying a product suitable for the consumer.”

Novofarina launched its own-brand Simpleas range at the beginning of Feb this year. “It’s taken us ten months to get to where we are with our healthy range of snacks – each pack is less than 90 calories, they’re lower in salt and fat, high in fibre and baked, not fried.”

This brings them within the CQUIN level needed for a product sold on NHS premises, such as hospitals. Simpleas is currently selling well in WH Smith hospital stores across the country, as well as in health food and farm shops, she reports.

“The other big area and one that’s really taken off is texturised pea protein (TPP) for meat replacement. This is traditionally made from soya, but we’re working in partnership with Healy Group to develop our line, and we’re currently selling significant volumes to food manufacturers.”

Driving the interest is the massive rise in veganism – the TPP fits perfectly the demands of the health-conscious, climate-concerned consumer says Vicki. “Along with the success of the snacks, our crumb and flour products, we’ve reached the stage where we have to consider how we can move premises and upscale.”

With just 12 staff in total currently, there’s a level of modesty and reserve about the company’s success, but she’s clear on the attributes of the range they sell. “Aside from the health and nutrition benefits, our products are grown by British, local growers, which gives them provenance. We have very good systems of traceability and quality assurance, and they’re derived from peas, a crop with a low carbon footprint and highly sustainable.”

Chris confirms that expansion is on the cards, but it poses Novofarina several challenges. “This explosion of interest has taken a lot of people by surprise. Everyone says it’s set to continue, but we’re mindful of changes in food trends and need to remain flexible and continue to develop our product range. What’s more, we like where are in Norwich, working with our group of local growers, and would rather see our expansion stay local. For that we need the right premises in in the right Norfolk location.”

There’s also the crop itself, and Chris is keen to see genetic advances that will improve the prospects for peas and help companies like Novofarina develop healthy, sustainable, nutritional food. “Peas are coming under pressure because of restrictions on the use of pesticides, but there’s some really interesting pre-breeding work going on at JIC,” he notes.

“Much more can be done, but getting funding for such work is always a challenge and it currently takes at least ten years to bring an interesting trait in. Gene-editing could help and would accelerate the process but its adoption by the UK in a post-Brexit world would be a brave step and might limit non-UK markets.

“An improvement in yield would be a game-changer for peas however, and would turn around prospects for the crop. It would ensure the crop was more widely grown, and that could have a massive impact on human nutrition and enable a healthier society.”

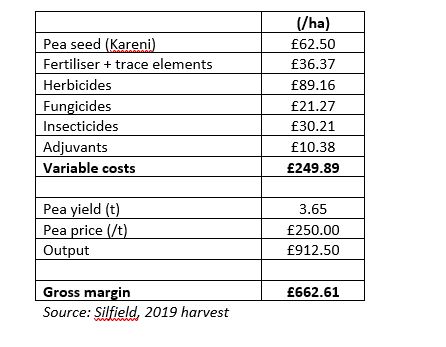

Silfield white/yellow peas: how the finances stack up